Best Payroll Software for Your Business

The list of best payroll software in India includes Keka, PocketHRM, WalletHR, HROne, Spine Payroll, and ZohoPay. Payroll management software helps to automate and simplify business hr payroll management.

Connect With Your Personal Advisor

List of 20 Best Payroll Software

Paychex is a well-designed payroll management software that allows great flexibility in managing various HR-related tasks. It encompasses services like payroll and taxes, insurance, employee benefits, 401 (k) retirement services, accounting and finance and PEO. Learn more about Paychex Flex

Starting Price: Available on Request

Rippling is a fully-featured Payroll Software designed to serve Agencies, Enterprises. Rippling provides end-to-end solutions designed for Macintosh. This online HR system offers E-Verify/I-9 Forms, Multi-Country, Employee Database, Recruitment Management, and Employee Lifecycle Management in one place. Learn more about Rippling

Starting Price: Available on Request

Build your remote team with Deel payroll software. Hire international employees and contractors compliantly around the world. Run payroll in hundreds of currencies with one click. Read Deel Reviews

Starting Price: Starting Price: $49 Per Contractor/Month

Recent Review

"Best deels" - Vivek Kumar

OnPay is among the most powerful payroll software available in the market. It is working from the last 30 years to help small business enterprises. It integrates with Xero, QuickBooks, etc. Read OnPay Reviews

Starting Price: Starting Price: $40 User/Month

Recent Review

"Review for OnPay" - Junaid Ahmad

Papaya Global is a fully featured Payroll Software designed to serve Enterprises, SMEs and StartUps. Papaya Global provides end-to-end solutions designed for Web App and Android. This online Payroll system offers Document Storage, Cap Table Management, Financial Modeling, Compliance Management, Reporting/Analytics, Scheduling, Self Service Portal, Vacation/Leave Tracking, Benefits Management, Direct Deposit, Document Management, Multi-Country and Multi-State at one place. Read Papaya Global Reviews

Starting Price: Starting Price: $20 Employee/Month

Recent Review

"review of papaya global" - Tehzeeb Raza

Oyster Payroll is a fully featured Payroll Software designed to serve SMEs, Startup, Agencies, Enterprises. Oyster Payroll provides end-to-end solutions designed for Web App. This Payroll System offers Dashboard, Vacation/Leave Tracking, Self Service Portal, Benefits Management, Document Management and Multi-Country at one place. Learn more about Oyster Payroll

Starting Price: Available on Request

Our secure online payroll system, paying your employees has never been easier. We’ll help you get started by setting up your payroll, employees, payroll tax information, etc. Read Patriot Payroll Reviews

Starting Price: Starting Price: $17 Per Month

Recent Review

"Best decision in a long time" - Ella

Gusto is the employee onboarding platform, offering payroll, benefits, HR tools, and world-class support for small businesses. With Gusto, it’s easy to take care of your team and grow your business all in one place. Read Gusto Reviews

Starting Price: Starting Price: $40 Per Month

Recent Review

"Review for Gusto" - Junaid Ahmad

Remote is a payroll software that empowers companies to pay and manage full-time and contract workers all over the world. In 50+ countries, we handle international payroll, benefits, taxes, stock options, and compliance. Most importantly, Remote never charges percentages or fees: one modest flat pricing keeps your budget under control so you can focus on expanding your business. Read Remote Reviews

Starting Price: Starting Price: $299 Employee/Month

Recent Review

"Transparent and effective with an amazing customer service " - Hanna Dazell

A Simple, Flexible, Accurate, and Compliant Payro

Ensuring Your Success with Darwinbox An intuitive UI that delivers efficient results in 3 steps: Input delivery, Payroll processing, Report extraction. Learn more about Darwinbox Payroll

Starting Price: Available on Request

Category Champions | 2023

Keka is a payroll software solution that simplifies HR-related tasks by automating the workflow for better and more accurate results. This Payroll Management Software is further equipped with a modern applicant tracking system that empowers HR staff to acquire the right talent. Read Keka HR Reviews

Starting Price: Starting Price: $97.21 Upto 100 Employees

Recent Review

"Easy way for tracking " - Minaxi Suthar

| Pros | Cons |

|---|---|

|

Easy for applying leave and plus setting up the task and OKRs. |

Not any so far. |

|

I guess Keka as Software itself is very useful. |

I didn't find such thing yet. |

Intuit Payroll is a robust payroll software that comes in two packages to suit various business needs. It offers a complete set of payroll features which include calculating payroll taxes automatically, instantly generating unlimited paychecks, and much more. Read QuickBooks Online Reviews

Starting Price: Starting Price: $69.44 Per Year

Recent Review

"Easy to access" - Manisha Garg

| Pros | Cons |

|---|---|

|

Its easy to use |

No cons |

|

Import feature, Export feature, auto suggestion appears while matching and their customization report feature. Their support system is awesome. |

It is not an easy software to learn, you need to have training before using it. Professional accounting base is necessary. Although they provide videos for training. |

Zenefits is the only small business HRIS that connect your payroll, benefits, other HR systems, and employee onboarding. It has a user-friendly dashboard and various novel features. Read Zenefits Reviews

Starting Price: Starting Price: $8 Per User

Recent Review

"Zenefits has been a big help!" - Evelyn Mauritsen

| Pros | Cons |

|---|---|

|

Human Resource laws are always changing, Zenefits keeps us on top of new laws and advises us how to proceed and what forms to fill out, etc. |

Getting in touch with them is sometimes frustrating but I realize they are busy answering other customers' calls. For the most part, I do not have a problem. |

|

Payroll, taxes, benefits, etc. |

Nothing comes to mind. |

With modern, intuitive technology and a world-class team of HR experts, Namely empowers people teams with an all-in-one HR solution designed for mid-sized businesses. Read Namely Reviews

Starting Price: Available on Request

Recent Review

"A very reliable HR software." - Abhi Sheth

| Pros | Cons |

|---|---|

|

Namely software is a web-based system which provides its support on a mobile device too. |

I didn’t find any cons in the software. Liked it very much. |

|

I will high recommend Namely software to other business colleagues. it is value for money |

Got to known about it a little late, the marketing team should promote it. |

Paycor payroll software optimizes practically every aspect of HR, from managing labor costs, time, and performance reviews to recruiting, retention and employee communication. Quickly and confidently pay employees from wherever you are and never worry about tax compliance again. Learn more about Paycor

Starting Price: Starting Price: $99 Per Month

UZIO is a SaaS-based online HR, benefits and cloud-based payroll management solution, provider. It is an ideal solution for any small to medium businesses who would like to move from paper-based tasks to a sophisticated HRIS platform. Learn more about UZIO Payroll

Starting Price: Starting Price: $4.5 Per Employee/Month

Category Champions | 2023

Payroll crafted for building a better workplace

Zoho Payroll makes payroll administration simple by automating everything from timekeeping to tax calculations. It handles everything from centralizing and organizing employee records and information to scheduling payrolls and managing statutory compliance. Read Zoho Payroll Reviews

Starting Price: Starting Price: $0.69 Employee/Month

Recent Review

"Well organised Payroll Processing" - Gopalakrishnan A V

| Pros | Cons |

|---|---|

|

Monthly computation with flexibility add/deduction of one time, flexibility of tax deduction, documentation & proof of approval of proof of investments |

Batch wise payrun to identify billable or non billable customewise/projectwise |

|

Easy to use, understand and implement. Very intuitive and uncluttered which makes user confident enough. Regular and timely product updates. Very precise product and training manuals. |

Can not be much customized in comparison to other Zoho Products. Calculation of yearly bonus as per payment of Bonus Act is not available. Multi level approvals not available. |

Emergents | 2023

Process payroll accurately and securely in 3 simple steps with ADP Vista HCM – a highly configurable and secure cloud-based payroll software designed for small, medium, and large businesses. With Vista HCM, you can generate all the necessary payroll and compliance reports easily. Read ADP Vista HCM Reviews

Starting Price: Available on Request

| Pros | Cons |

|---|---|

|

Good software but has limited features |

Very complex to use |

CheckMark is the perfect Payroll system. Easy to use and affordable for any size and any type of organization for an unlimited employee. Accurately calculate salary, deduction, P.F., Overtime etc and generate Salary slip. Read CheckMark Reviews

Starting Price: Available on Request

Recent Review

"Highly recommend accounting tool" - Darshan Nathani

| Pros | Cons |

|---|---|

|

If you are in search of an accounting software tool that will proffer all-inclusive solutions for all the accounting needs of the business then you research will come to an end with CheackMark, the leading accounting software. It will take care of all you |

Doesn’t have mobile app support |

ELMO is the leading employee onboarding platform to provide Talent management, Workforce investigation and effective tools to consistently manage recruiting, onboarding, learning, performance management, progression and HR Core. Read ELMO Cloud HR & Payroll Reviews

Starting Price: Available on Request

| Pros | Cons |

|---|---|

|

Good marketing and sales pitch however it stops there. |

Very poor service delivery. They do not implement what they show you during sales. Teams at ELMO operate in silos. HR is implemented by a different team to Payroll. No project oversight by ELMO, client has to push to get results. Cost high to what you end up getting. System is clunky and still under development. Far from being perfect. |

Until 31st Mar 2023

How does Payroll Software Work?

Modern Cloud Payroll software is a central platform that handles the payment of employee salaries, calculates time spent on activities, and regulates taxes speedily and accurately.

Payroll solutions help organizations enhance productivity, reduce administrative paperwork, and decrease the rate of human error in manual tasks. Payroll management systems even work as great morale boosters for employees, as they get their paychecks regularly with no errors or mismanagement.

While the software may seem complicated, it simplifies crucial human resource operations and increases the overall output. Here are some ways that it can work for your organization:

1. Advanced Business Features: Most current payroll software for small businesses has innovative business features such as tax regulation, accounting, salary calculation, and timekeeping, thus making functional tasks simple for human resource managers. It saves time spent on routine activities

2. Tax Regulation: Managing tax calculations compliant and correct manner is challenging for any organization. Online Payroll software is fully equipped to handle the intricacies of tax management and ensures that an organization complies with the latest government regulations and policies regarding taxation. Payroll solutions are a helpful asset that can help in comprehensive tax management in any organization, reducing the workload of the human resource department.

3. Employee Timekeeping: An online payroll system will prove beneficial for your organization because it can keep track of your employees' work hours and maintain an updated record of how they spend their time in the organization. It also pumps up employee accountability and leads to a substantial rise in productivity as strategic goals can be achieved faster.

4. Recording and Reporting: Payroll solutions are ideal for companies to record employee information structured and orderly. The complete payment calculations are performed automatically, deducting the required amount for gratuity, retirement benefits, and taxes, ensuring that your organization stays tax compliant and avoids any hefty fines or punishments.

A dynamic payroll software program will eliminate any problems or roadblocks in the path of effective employee management, and it will also lay the groundwork for achieving the strategic functional goals of the organization. There are several sophisticated online payroll systems software available in the market. So, it is necessary to evaluate individual, and organizational requirements, narrow down the choices, and pick the best payment system.

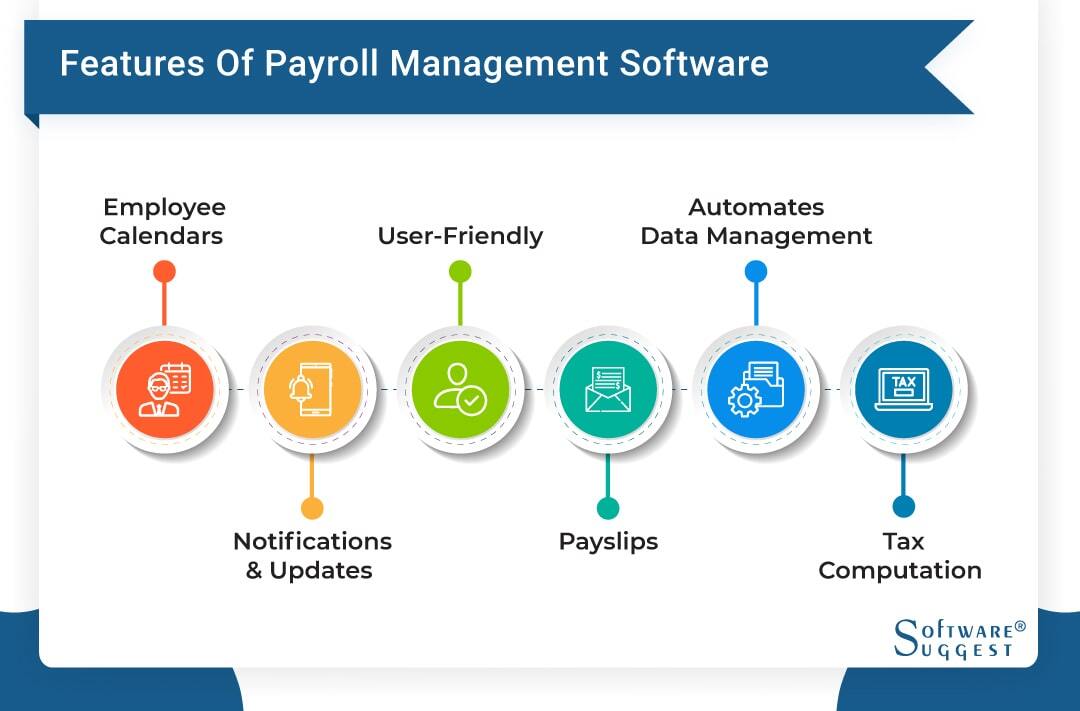

What are the Features of Payroll Management Software?

Let us look at some of the standard features and payroll checklist

1. User-friendly: An hr payroll software is so designed that any non-tech-savvy person can easily use it. It provides a centralized dashboard from which you can easily navigate to all other functionalities. When employees themselves work on the salary management software without seeking professional help, a lot of money is saved in this process.

2. Notifications and Updates: Payroll management software keeps reminding you of important notifications like tax payments and salary due dates. You can also set reminders for different tasks still pending, such as approval of a leave request, etc.

3. Employee Calendars: Payroll calendars are easy to manage in different aspects of employee status, like checking on sick leaves, absences, and overtime. Time & attendance management software with payroll helps employees to make plans and decisions on a particular day. At a glance, all kinds of information on the employee can be obtained, like how long they have taken leave, whether to allow more leave or how much-paid leave is entitled to them.

4. Payslips: This salary slip module helps you generate payslips so that your employees and company can keep the payment records.

5. Automates Data Management: Automating the data management software in this payroll management software helps speed up your work process and saves time. Besides, it eliminates the chance of human-made error and ensures accuracy.

6. Tax Computation: Most advanced solutions have a tax computation module that helps you accurately file your tax on time. It stays in compliance with all updated government regulations and helps avoid hefty fines for miscalculations or failing to file taxes.

What are the Advantages of Payroll Software?

By automating manual (and error-prone) processes, HRMS payroll software solutions assist you in conducting employee salaries, wages, bonuses, and deductions. It also keeps track of paid time off, vacation, and perks.

Some of the additional benefits of using an employee payroll management system are listed below:

1. Saves Time

Setting up and processing payroll via attendance and payroll software solutions is relatively easy. This renders them user-friendly.

Payroll programs minimize the need for manual tracking and payment. This helps your team save time, which may be redirected to other areas of your company, resulting in increased productivity. Tasks such as calculating salary and timesheets can be carried out as fast as 20 seconds.

2. Enhances Compliance

Tax rules and regulations are subject to change regularly. It may be challenging to calculate taxes, and missing deadlines can result in expensive fines and penalties for companies.

The payroll system software helps businesses remain compliant by providing information and reminders about payroll compliance needs. It is designed to apply tax deductions automatically and track payments in real-time. Some HRMS payroll software can also generate reports for filing tax requirements automatically.

3. Generates Reports

An hr payroll software enables you to generate reports for internal decision-makers, accountants, and auditors. Summaries of quarterly costs, yearly tax payments, and historical employee benefit participation are all examples of what may be found in a payroll report.

Furthermore, reporting capabilities, such as cost summaries and tax payments, are frequently included in hr payroll software solutions.

4. Automates Payment Disbursement

You may also use payroll programs to automate the payment disbursement procedure. Using attendance with single touch payroll software, you may customize hourly or salaried staff and save a lot of the tedious labor of calculating hours and paychecks.

Also, most hr payroll software systems allow you to provide your employees a choice in how they receive their pay. You may keep employee preferences in the system to ensure that their chosen mode of payment is used every time.

5. Reduces Outsourcing

Payroll services reduce the risk of disclosing sensitive information about your employees to a third party. You get complete control over your financial data.

Besides, employers can restrict access to the payroll information of their employees. Employees can easily view their payroll information on the self-service portal. It ensures complete transparency.

The Disadvantages:

1. The salary software needs a lot of data inputs about the employees. Since this is done manually, this may lead to errors/ payroll mistakes.

2. If the employer outsources the data work to the service provider, they have to pay for these services, which might be expensive.

3. If the service provider does the salary management software data task, one cannot expect immediate help from the service providers since they might provide similar services to many other clients.

Offline Payroll Vs Online Payroll Systems

1. Time Consumed

Running Payroll on software can take minutes while doing it manually can consume hours. You must do all the calculations manually when you are doing payroll. You must add employee hours, determine time and overtime pay, consider all the compensation and taxes, and deduct other benefits, contributions, etc.

This is not it; you must calculate each employee's paycheck individually. Doing it manually might consume a lot of your time. Also, you must be aware of all the taxes and labor laws, and learning all these might take a while.

On the other hand, the payroll program will assist you in processing the payroll in the simplest way possible. When hired, you need to input an employee's information, and the software will automatically calculate taxes and other deductions. Some programs will also process Form-16 forms for every employee at the end of the year, which can be a real-time-saver.

2. Errors

Manual Payroll is the most error-prone method. There is more room for mistakes here. When calculating it manually, you might forget to subtract a deduction or add employee hours.

Watch out for any incorrect calculations, as it is possible that you might add, subtract, or multiply wrong numbers. This can lead to incorrect calculations, and the wrong amount is paid to your employees. If this happens, your employees have an absolute right to sue you. You not only have to pay back the wages but also hefty legal fees for a small mistake.

The Best Payroll Software will save you from all these hassles by preventing mathematical errors. The online payroll system software is robust enough to calculate the gross wages of each employee and subtract taxes and other deductions. The software will inform you how much you should pay for the employment tax. You no longer have to worry about incorrect calculations and financial consequences.

3. Attendance Management

The majority of payroll solutions are integrated with attendance machines. Hence, these automated processes take care of the calculation part of attendance management, eliminating errors and transparency.

Manual Payroll means doing everything by hand, while online payroll software means you can store years of data in one centralized location, thus keeping track of everything.

While using a manual payroll, you have to keep track of employees’ time by hand. Still, with a software application, you can automatically transfer the punch or swipe by integrating the software and the biometric attendance system. This will also separate regular work hours from overtime and calculate different remunerations according to the parameters set.

How to Choose the Right Payroll Software for Your Business?

Enterprise payroll software for small businesses can completely transform how your organization functions. It is a roadmap for automated payroll processes and brings about a high level of work efficiency by reducing administrative procedures to a large extent.

When investing in a new payroll solution, carefully weigh your organization's needs and budget. You need to look at the complete package holistically and check whether it will fulfill all your obligations.

-

Does the service provider have the specific features that you are looking for?

-

Do payroll services provide good support features?

-

Can you customize the payroll solutions according to your specific business requirements?

You may have to answer these vital questions before picking out the best payroll software for small businesses. Let's study these factors in detail.

1. Cost

Businesses are looking for affordable solutions. The cost is the foremost priority when deciding on an automated payroll system. Check for hidden fees that might be overlooked during the initial service cost comparison. Make sure to read the brochure and fully understand what features should be included and what not in the final price.

Ask even the silliest question that comes to your mind so that you aren't surprised when you receive the bill. Make sure what is included in the payroll and what is not. If you plan to hire more employees in the future, ask about the approximate cost per additional worker.

2. Features

Here are some features that should be considered when choosing an automated payroll system.

-

Payment Type: How do you want to pay your employees? Direct deposits, paychecks, or payroll cards? You want your payroll system software to support how you pay your employees.

-

Pay Period: When do you want to pay your employees? Every week, bi-weekly, or at the end of every month? Choose software that lets you pay your employee whenever you want.

-

Supplement wages: If you pay your employees bonuses, commissions, or tips, you need a service provider that can support supplement wages.

-

Time and attendance: Time and Attendance help track the number of hours your employees work. You can have your employees enter the hours online or enter them yourself.

3. Support

HR payroll software offers firm support and makes you feel more comfortable running your payroll. Some companies help you set up your automated payroll system. If support is the priority, compare the software's support level.

4. Free trial

Some providers offer a free trial to know the software's ins and outs. A free trial will help you know precisely what you are purchasing. Therefore, check if the HR payroll software you are considering offers you a free trial. It helps you have a hands-on approach and temporarily runs your payroll at no additional cost.

5. Contract

Don't get strapped into a year-long contract. And if you have to ensure that the software you are considering meets all your needs. You might have to pay a fee to drop out early. Contracts are made to get stuck to the software; if you want to exit, you must pay a dropout fee.

It's better to go with payroll apps without contracts than turn it down without fees. Every option has pros and cons; better consider your business needs before making the final call. If you comprehensively go through this checklist, you will be able to invest in the most suitable provider for your small business.

What Are the Common Problems With Payroll Management Software?

There are several challenging situations organizations face while implementing the best payroll system. Let's understand some of the primary challenges that companies need to overcome for payroll solutions:

1. Getting Support From Top Executives:

It is often difficult to obtain buy-in from the top-level hierarchy of the organization as they may prefer to outsource the entire function. Hence, top executives need to be convinced about the benefits of the best payroll software for small businesses to decide to invest in payroll tools.

2. Getting Buy-In from the IT Department:

Another huge challenge to successfully implementing a payroll system is getting the support of your organization's IT department. They may have concerns about the security of data and software hosting. The IT department of the organization should have enough resources to integrate payroll apps for small businesses successfully, and ensuring this may prove difficult for companies.

3. Getting the Perfect Fit:

Smaller businesses may have a problem getting the best payroll system for small businesses that cater to their daily operational requirements, as most of the solutions are targeted toward big firms. Some essential features such as attendance management software or benefits management may be add-ons or optional, creating functional difficulties.

4. No Integration with Existing Systems:

Top payroll software must be integrated with the organization's other Human Resource Management Software and existing systems to store data securely in one place. However, not all vendors offer integration; this can be a significant challenge.

Surmounting these challenges can be quite a task; however, once you get past them, your organization will attain several business results that will fast-track it to success.

How does the Payroll System Contribute to Business Growth?

There is no room for trial and error while investing in payroll tools. These vital strategies will help you select the right payroll system and ensure your business is well-prepared for unexpected changes.

1. Select A Payroll Solution That Allows Company Growth:

One primary strategy to help your organization prosper with payroll system software is investing in an application that allows for future business growth. Make sure the software you choose will adapt to future payroll tool's needs rather than just meeting the current requirements.

2. Integrate Your Software with Other Functions:

Integrating all business systems is a vital strategy to take your organization's place. Integrated payroll programs can help unify diverse functions of your business; hence, it makes more sense to invest in it than in standalone accounting software.

3. Designate a Payroll System Specialist:

It's essential to have someone on your team familiar with the intricacies of open-source payroll software for small businesses. A specialist will manage the entire software efficiently and enhance the system's accuracy, whether hired internally or externally.

These strategies are sure-shot ways of improving your business through the best payroll system for small businesses. So, make sure to choose the right strategy before making a big choice!

Comparison of Payroll Software

Comparison Details

We have created a comparison table that helps you to discover the best payroll software for your business. Read about the free payroll management software trials, pricing, and best for companies to choose your payroll software. For in-depth details, you can visit the company's page.

|

Name

|

Free Trial

|

Pricing

|

Best For

|

|---|---|---|---|

| Yes |

INR 6999/Month |

Small Businesses | |

|

Yes |

INR 4995/Month | Mid-Sized Businesses | |

|

Yes |

INR 195000/One Time |

Scaling Businesses | |

| Yes |

INR 1499/Month |

All-in-All Solutions | |

|

Yes |

INR 50/Employee |

SMBs |

What are the Best Payroll Software Vendors By Company Size?

Payroll programs manage payroll services such as payroll taxes, remuneration, year-end bonuses, pay stubs, paid time off, benefits administration, and employee data.

Many businesses outsource their payroll processing services, but you may decide that keeping it in-house is the best option for your business. Several attendances and payroll software India has could help you do so.

You can choose the best software for your company size based on what suits your needs the best. This section talks about the best payroll management software vendors by company size.

Best Payroll Software Comparison for Enterprises

Large businesses and enterprises usually aim beyond the HR department into an Enterprise Resource Planning (ERP) Software package. Ideally, this includes complete payroll services like talent management and potentially a human capital management system. Enterprises hope to guarantee that payroll and other HR activities, as well as accounting and other department-specific systems, are completely integrated.

Some of the fabulous picks of payroll software vendors for enterprises include — Paycom, Workday HCM, and UKG Ready.

|

Features

|

Paycom

|

UKG Ready

|

Workday HCM

|

|---|---|---|---|

|

401 (K) Tracking |

Yes |

No |

Yes |

|

Benefits Management |

Yes |

Yes | Yes |

|

Payroll Outsourcing |

No |

No |

Yes |

|

Tax Compliance |

Yes |

Yes |

Yes |

Best Payroll Software Comparison for Medium-Sized Businesses

The HR managers at midsize businesses aim to benefit beyond basic payroll functionality. Onboarding, direct payment, tax filing, and other services like attendance monitoring and time tracking have become more helpful at this level. And medium-sized companies will want a more comprehensive human resources management system.

Some fabulous picks of payroll software vendors for medium-sized businesses are ADP Workforce Now, Paylocity, and Rippling.

|

Features

|

ADP Workforce Now

|

Paylocity

|

Rippling

|

|---|---|---|---|

| Yes |

|

Yes | |

|

Benefits Management |

Yes |

Yes | Yes |

|

Self-Service Portal |

Yes |

Yes | Yes |

|

Compensation Management |

Yes | Yes | Yes |

Best Payroll Software Comparison for Small Businesses

A small business owner who wants to optimize payroll processing will want a solution focused only on payroll and low base prices. You may be doing your payroll right now, so you will need to discover the finest software for payroll management for your small business.

Some of the best payroll software vendors for small businesses are Gusto, OnPay, and SurePayroll.

|

Name

|

Free Trial

|

Pricing

|

Link

|

|---|---|---|---|

|

Payroll Outsourcing |

No |

Yes |

No |

|

Payroll Reporting |

Yes |

Yes | Yes |

|

Wage Garnishment |

Yes |

Yes |

Yes |

|

Muilt-Country |

No |

No |

No |

What are the Latest Market Trends in Payroll Software?

Some latest market trends in payroll software that might stay relevant for quite a long time are:

1. Integrated Software Solutions

Integrating hr and payroll systems with other systems like accounting and HR offers you more control and insight over your data and operations. It eliminates data duplication and redundancy. This allows businesses to receive a complete view from a single data source. Organizations can better understand their employees by integrating payroll with human capital management tools.

2. Employee Portals Gaining Appeal

Employee portals are gaining popularity as HRMS payroll software is becoming more employee-centric across the board. Employee portals are becoming more widely available as SaaS and on-premise systems. Among the employee-focused features is the ability to file their taxes, access their payroll data, personal benefits, and bank accounts for direct deposit, view pay stubs and timesheets, and plan for and report absences.

3. Artificial Intelligence Taking the Lead

In payroll systems, artificial intelligence (AI)-driven chatbots can help employees with their questions. AI may also assist in classifying personnel into the appropriate tax band. HR personnel will save time as a result of all of this.

4. Increasing Preference for Cloud-Based Software Software

Web-based payroll software is becoming more popular. A Saas payroll software also helps to manage and increase preference. Due to the regular changes in tax rules, any online payroll software you purchase will need to be updated yearly. Cloud-based payroll software and services are an excellent solution to this problem since providers update the software with legal changes immediately, making tax compliance simple for you.

Top Payroll Software with Pros and Cons

1. Keka

Keka software provides one of the best all-in-one hr payroll services, enabling you to automate your payroll process and achieve complete efficiency. It can do everything from accurately calculating your employees’ salaries to disbursing them directly to their accounts. Moreover, it considers leaving, bonuses, and other pay compensation factors while calculating an individual’s pay. Global brands like Oyo, Aditya Birla, and UpGrad use Keka to manage their payroll management software process.

Some of its features are:

- Expense Management Loans And Bonuses

- Leave Attendance Management

- Attendance Management

- GPS Attendance

Pros

- Dedicated mobile apps

- Customer service

Cons

- A bit complicated to use

USP

One best things about Keka is that it complies with Indian Statutory rules, including TDS, labor welfare fund, provident fund, employee insurance, and others, to help avoid any kind of penalty.

2. WalletHR

WalletHR Software is a robust hr payroll application integrated with human resource management software. It can be deployed across various industries, including retail, service, and manufacturing. Moreover, it claims to process payroll for 10k employees in 10 minutes. Its seamless integration with attendance modules makes the job easier for the HR manager. Besides, this simple payroll management software offers an employee portal whereby payslips are configured and published.

Some of its features are:

- Comprehensive loan management

- Deployed both on-cloud and on-premise

- The full and final settlement

- Benefits management

- Data generation

Pros

- Responsive interface

- Reliable customer service

Cons

- Users reported a few bugs

USP

One unique thing about WalletHR is that it can easily configure different organizational salary structures.

3. Pocket HRMS

Pocket HRMS is a cloud-based HR system that comes well-equipped with payroll solutions. It offers payroll solutions tailored to specific industry needs, including manufacturing, construction, real estate, schools, BSFI, and more. HR personnel can easily prepare and file tax returns using online payroll software. It can generate necessary tax forms like eTDS Form 24Q. The best thing is that after accurately calculating employees’ salaries, you can automate the process of disbursing the amount to their account directly.

Some of its features are:

- Self-service portal

- Expense management

- Statutory compliance

- Attendance and time tracking

- Employees benefit management

Pros

- Convenient and reliable

- Auto-generated payslips

Cons

- Lack of search box

USP

Pocket HRMS offers a mobile application to manage your payroll services on the go. Besides, it complies with all applicable employment and tax laws and regulations.

4. HRMantra

HRMantra Software is an award-winning payroll solution that handles the most complex payroll structure. This payroll application can also help calculate salaries, employee benefits, bonuses, loans, and taxes. With their online payroll services, you can define any number of perks and create unlimited pay heads. Another good thing about HRMantra is that it allows you to import data from export to calculate and process salary and the current month’s payroll data.

Some of its features are:

- Deduction adjustments

- Payslip report

- Extra PF adjustments

- EMI calculations

- Loan or salary advances

Pros

- Fully customizable, User-friendly interface

Cons

- The loading page is a bit slow

USP

HRMantra allows you to generate various reports, including salary statements, Form 16, PF, ESIC statements, challans, loan transactions, arrears exemptions, and TDS reports.

5. Qandle

Qandle Software is another award-winning payroll solution with a comprehensive suite of features. Companies like Channel, Edureka, and more use Qandle to handle their payroll services. You can easily design the compensation policies and incentives by department, location, and grade within the application. Besides, you can even disburse bonuses, profits, and one-time payouts as per the requirement. What’s more, payroll programs help you verify all employee claims and investment proof.

Some of its features are:

- Records Database

- Employee Self Service

- Returns filing

- Reports and Analytics

- Compliance updates

Pros

- Highly configurable

- Easy to use

Cons

- Loading speed is slow

USP

Its integration with attendance and leave management automatically syncs with loss of pay data for effective processing.

6. BatchMaster HeRd

BatchMaster HeRd is one of the best payroll solutions that all types of businesses can use. It offers a comprehensive solution whereby you can automate the process of employees’ salary processing and generating payslips and bank reconciliation reports. While calculating salaries takes into consideration various allowances like medical, mobile, and transport, and deductions such as professional tax, TDS, PF, and others. Moreover, this payroll application syncs with other modules such as HR, time and attendance management, and more.

Some of its features are:

- Leave management

- Payslip generation

- Employee Portal

- Mobile apps

- Attendance tracking

Pros

- Seamless integration Reliable support

Cons

- Not so user-friendly

USP

It simplifies tax processing by helping employees from different pay bands make a tax declaration every fiscal year.

7. Saral PayPac

Saral PayPack is a simple yet powerful payroll system software designed to meet every aspect of payroll processing. From tracking attendance punch to payslip generation, it is well-equipped with tools to carry out every related functionality. Payroll management software can be deployed on-premise and on-cloud to enable you to access the system on the go. Moreover, the system ensures that your business stays compliant with all laws and regulations, such as PF, TDS, PT, ESI, etc.

Some of its features are:

- Leave management

- Exit management

- Reporting and analysis

- Reimbursement management

- Employee self-service

Pros

- Simple and easy to use

- Customizable

Cons

- Customer service can be improved

USP

Saral PayPack’s easy real-time integration with any biometric device to record attendance improves payroll processing accuracy.

8. Zoho Payroll

Zoho Payroll is a leading online payroll software streamlining the payroll management process. It acts as a centralized database for all your employees’ information and records and allows you to schedule payroll processing. Payroll software is well-known for its high accuracy and ability to file returns. Zoho Payroll ensures that your company complies with all applicable laws and regulations in India. Companies like Indiefolio, Tartlabs, Webcasts, and more trust Zoho Payroll for their payroll activities.

Some of its features are:

- Supports diverse salary structures

- User and access control

- Salary and payslip templates

- Loan management

- Secure employee portal

Pros

- Password-protected files

- Fast and straightforward to use

Cons

- The application does not allow easy navigation

USP

Zoho Payroll offers an employee self-service portal whereby managers can post announcements and other information accessed by employees.

9. 247HRM

247HRM Software offers a complete HR-related solution - from payroll and taxes to performance management. With its interactive dashboard, you can easily keep track of every activity and interaction with visual charts. The employee self-service portal accelerates basic HR processes, such as task management, scheduling, and leave requests. There is also a help desk where employees can communicate directly with HR if they have any queries.

Some of its features are:

- Custom workflows

- Performance appraisal

- Skill management

- Statutory compliance and income tax

- Payroll and expense reports

Pros

- Reliable customer support

- Generation of reports in real-time

Cons

- UI needs improvement

USP

247HRM allows you to send SMS alerts whenever you need to notify your employees of any changes or developments.

10. Spine Payroll

Spine Payroll is an advanced payroll system with an intuitive and interactive interface. Payroll programs offer a comprehensive suite of functionalities that include recording and maintaining employees’ information and accurately calculating salaries while staying compliant with all statutory laws and regulations. Besides, it can be deployed across various industry verticals, including manufacturing, health, finance, and more. Moreover, it enables you to generate and share payslips and IT projections via email with one click.

Some of its features are:

- Expense management

- Multi-user login & role-based access

- Reimbursement management

- Bonus, loan, and advances management Mobile support

Pros

- Scalability Report generation

Cons

- Users reported a few bugs

USP

One exciting feature of Spine Payroll is that it enables users to generate customized graphs on net salary, employee count, and more by department and branch type.

Related Articles

- Best Tools to Calculate Cash Burn Rate

- Must-Check Best Payroll Apps For Android

- Top Payroll Software for Recruitment Agencies

- Ways to Defeat Payroll Costs: All You Need to Know

- Typical Payroll Accounting Software Problems & Solutions

- How do ESS Portals Help in Managing Payroll issues?

- Understanding The Fluctuating Workweek Method & Overtime Calculation

- Top Hourly Paycheck Calculator Can Make Your Life Easy

- Tips for Successful Payroll Management Services

- Why Use Payroll Automation?

- Best Payroll Practices to Definitely Work

- Why Processing Payroll on Excel is Hurting Your Company

- Pay Transparency: Overview, Pros and Cons

- Free Payroll Tax Calculator for Employers

- Best Payroll Software in Australia

- Factors to Consider if Replacing Payroll System is your Next Move

- Forget Manual Payroll: Reasons to Switch to Payroll System

- Payroll Process: Manual Vs Automated Payroll Processing, Winner Revealed

- 15 Best HR & Payroll Templates In Excel for Free Download

- Comprehensive and Effective Ways of Using a Payroll System

- Difference Between HR and Payroll Software

- Pros and Cons of Outsourcing Payroll for Your Business

- New Pay Trends: How Employees Reshaping The Payroll System

FAQs of Payroll Software

Investing in payroll systems for small businesses can help you achieve this motto. The way SMEs handle human resources is not very productive. There is hardly any attention given to human error and its effect on employees and the entire organization.

This is why Small Businesses need comprehensive HR and payroll software. Also, the software has many benefits that will ensure efficiency, timeliness, accuracy, precision, and cost-effectiveness. It's automated as well it gets seamlessly integrated with attendance and time management, allowing the HR team to focus on core business values and not always remain stuck to administrative work.

why small businesses need payroll:- No Technical Expertise is Needed: Small businesses are reluctant to use cloud payroll software because they are living with a misunderstanding that it takes a high level of skills and expertise to use the software effectively. However, this is not true. Plenty of modern payroll management applications are easy to use and simple to learn. User manuals and supporting tutorials are often provided to help the user with essential tasks.

- Saves a Lot of Time: According to the SCORE, a small business spends between one to five hours monthly calculating payroll. This number doesn't even include the other 41 hours spent on year-end tax preparations. This is where a payroll app for small businesses can save a lot of your time which you can spend on other things.

- Customizable Enough to Fit Small Business Needs: The compensation structures for various roles, benefits, and bonuses for all of these tasks can be customized and tailored to suit your organization's unique needs.

Payroll Software in following cities

Payroll Software in following industries

- Accounting & CPA

- Advertising

- Agriculture

- Architecture

- Auto Dealership

- Banking

- Banking & Mortgage

- Construction

- Consulting

- Distribution

- Education

- Engineering

- Food & Beverage

- Government Agencies

- Government Contractors

- Healthcare

- Hospitality

- Insurance

- Maintenance & Field Service

- Manufacturing

- Media & Newspaper

- Nonprofit

- Oil & Gas

- Pharmaceuticals

- Real Estate

- Retail

- Transportation

- Trading

- Textile

- Financial

- Hotel & Restaurant

- Sales

- Fashion

- PSA

- Talent Management

- eCommerce

- FMCG

.png)

.png)

.png)